Recent General Posts

Advance and Bermuda Run Homeowners, do you know what your homeowners policy covers?

8/19/2019 (Permalink)

Possible coverage issues in Bermuda Run?

Possible coverage issues in Bermuda Run?

Do you know what you homeowners insurance covers? Many of us lay our heads down at night comforted by the knowledge that should something happen to our home it will be covered under our homeowners insurance policy. Homeowners insurance is a must have for anyone that owns a home, whether your have a mortgage or not. Your coverage should bring you considerable piece of mind, but there are things that are not covered on your typical homeowners policy. Some of these items we have covered before, but these issues are so important that we like to revisit them. For Example:

- Earthquakes/Floods. Earthquake coverage has to be purchased as a separate policy or as an add-on to you standard policy. The same goes for flood insurance which must be purchased through the National Flood Insurance Program.

- Sewage Backups: Sewage backups are not typically covered under your standard policy. Coverage for a sewage back up must be purchased separately. This coverage should be purchased or added to any homeowners policy.

- Termite/Bug damage: Termite and bug damage are considered by the insurance industry to be preventable and as such would not be covered. Make sure you have a termite inspection as a regularly scheduled part of your home maintenance plan.

- Burt Pipes: Most burst pipes are covered as “sudden and accidental” however if your insurance adjuster inspects the damages and determines that it is the result of a lack of maintenance then they would not cover the event.

- Trampolines: Some policies exclude items that they deem to be at a greater risk of causing injury such as trampolines or a diving board at your back yard pool.

In order to make sure you are not exposed to these non-covered items, schedule a meeting with your insurance agent and discuss the specific items covered and not covered. Use this list as a jumping off point to make sure you are protected. As a homeowner in Advance or Bermuda Run you can rest assured that SERVPRO of Davie and Yadkin Counties can assist with any water, fire or mold issues you may have. Just call our office at 336 677 1415.

Restoration certifications for contractors?

5/18/2018 (Permalink)

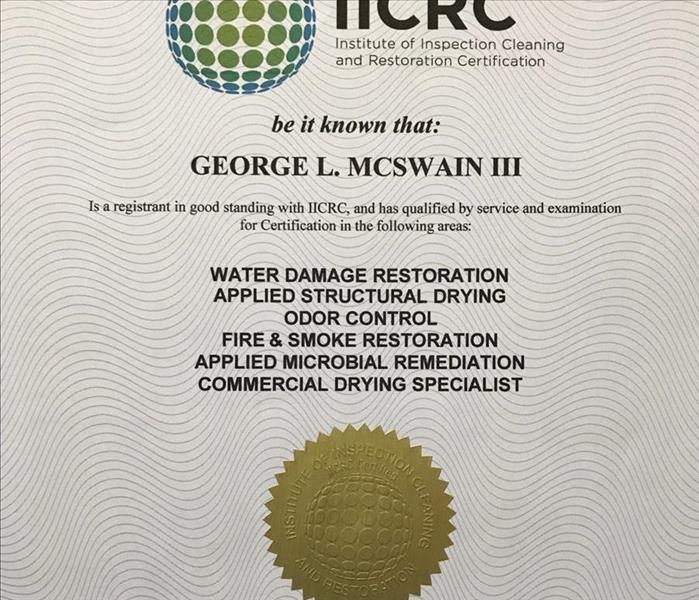

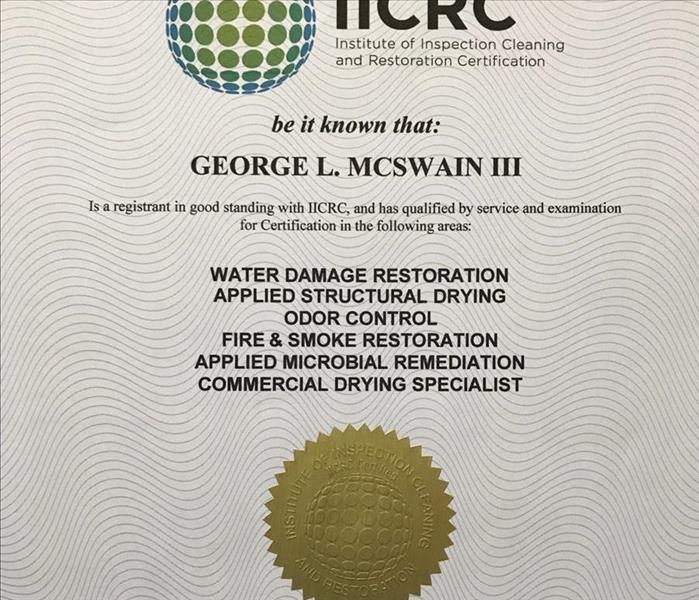

IICRC certified in Mocksville NC

IICRC certified in Mocksville NC

The IICRC is the leading sanctioning body for the restoration industry. The Institute for Inspection Cleaning and Restoration Certification is a standard setting and educational organization to ensure that technicians working in the water, fire and mold damage industry have the technical knowledge to perform their advertised work.

SERVPRO of Davie and Yadkin Counties technicians have earned the following IICRC certifications:

- WRT: Water Restoration Technician. This certification provides education for technicians in the restoration of a water damage using the science of drying. It also covers basics in containing and removing mold growth and sewage contamination.

- ASD: Applied Structural Drying. Applied Structural Drying. This Certification provides advanced concepts behind evaporation as well as hands on drying application with equipment.

- CDS: Commercial Drying Specialist. This certification teaches technicians advanced concepts related to building structure and construction along with advanced psychometric concepts to allow them to manage even the most complex commercial water damages.

- AMRT: Applied Microbial Remediation Technician. This certification covers the safe remediation of sewage and mold damages with emphasis on homeowner and technician safety while ensuring the structure is safe and inhabitable.

- FSRT/OCT: Fire and Smoke Restoration Technician and Odor Control technician. These combined certifications cover the technical aspect of fire and soot restoration as well as eliminating the odors left from a fire damage. Odor control from biological sources such as decomposition is also addressed.

SERVPRO of Davie and Yadkin Counties also have trained AMRT bio hazard removal technicians available to address any trauma or crime scene restoration needs.

Most residential contractors do not possess these certifications. Make sure you entrust your home or business to certified professionals.

If you live in the Mocksville area make sure that your remediation contractor posses the skills and knowledge to treat your individual loss, whether it is fire, water, mold or bio hazard. SERVPRO of Davie and Yadkin Counties makes sure that their technicians are fully trained and continually certified to deliver state of the industry mitigation. 336 677 1415

Is my Sewage Back up covered under my Homeowners Insurance?

5/7/2018 (Permalink)

Homeowners Coverage in Advance and Bermuda Run NC

Homeowners Coverage in Advance and Bermuda Run NC

If you experience a sewage back up into your home from a blocked drain line or septic tank will your homeowners policy cover the clean up and resulting damage? The answer is, no, if you do not have a sewage rider. A rider is additional coverage for an event not typically covered in your homeowner’s policy. Sewage back up is one of the situations that is not covered in your basic homeowners policy. That means you need to have a specific conversation concerning your coverage for this type of event with your agent. Because of the risks involved in handling and treating raw sewage the cost of the cleanup tends to run higher than a typical water damage. Items that can typically be cleaned and dried in a normal water damage (not sewage related) must be removed and disposed of when contaminated by sewage. All homeowners in the Advance and Bermuda Run area need a sewage rider added to their coverage to ensure they are protected from a particularly costly and potentially dangerous event. Have a conversation with your agent today to address your exposure to a sewage loss as well as other items that are not covered in a typical homeowners policy. See our earlier bog post concerning things not typically covered by homeowners insurance. Call SERVPRO of Davie and Yadkin Counties, 1 336 677 1415 to assist with your water damage needs.

Five things not covered by Homeowners insurance

4/21/2017 (Permalink)

Do you know what is covered under your homeowners policy?

Do you know what is covered under your homeowners policy?

Many homeowners in North Carolina assume that their homeowners insurance covers them from any and all damages. This false sense of security can lead them into situations where their coverage is insufficient or nonexistent. I have listed five areas where many homeowners assume they are covered but are not. Have a conversation with you agent to address any areas where you may be overexposed.

Mold: Your standard homeowner’s policy in the state of North Carolina only covers mold up to $5000.00 in damages. Some states have different policy limits for mold or exclude coverage all together. The best way to prevent mold is to be proactive in stopping any water intrusion. If you have a leak, get it dried out professionally as soon as possible. Call SERVPRO of Davie and Yadkin Counties for help with your water issues at 336 677 1415.

Sewer Backup: Sewer backups are not covered by your standard homeowner’s policy. Make sure you have a sewage backup endorsement of a sufficient amount to cover any potential losses. $5000.00 in sewage backup coverage will be gone in a hurry if your entire finished basement is flooded with two inches of sewage.

Earthquake: You standard homeowner’s policy will not cover damage from earth movement. Surprisingly, the East coast of the United States has a number of active fault lines. Make sure you understand your risk from an earthquake and have a conversation with your agent about appropriate coverage.

Flood: Water on the ground from rain or a storm/hurricane event coming into your home is not covered. Flood insurance can be purchased separately through FEMA and the National Flood Insurance Program .

Damage from Construction Work: If you are remodeling your home, a standard homeowner’s policy won’t cover any damage done to your home by a contractor. When you hire a contractor, make sure they carry sufficient liability insurance.

24/7 Emergency Service

24/7 Emergency Service